On April 12th, Zeekr X officially announced the price and related purchase rights, with three versions of the new car to be delivered in June of this year.

The ME version, with a 66kWh battery and a range of 560km (CLTC standard), is a five-seater rear-wheel-drive model priced at 189,800 yuan; the YOU version, with a 66kWh battery and a range of 560km, is a four-seater rear-wheel-drive model priced at 209,800 yuan; and the YOU version, with a 66kWh battery and a range of 512km, is a five-seater four-wheel-drive model priced at 209,800 yuan.

At the launch event, An Conghui continued Zeekr’s usual style of questioning traditional luxury car manufacturers with five soul-searching questions about design, performance, intelligence, space, and luxury, with each question pointing to the traditional luxury giant BBA.

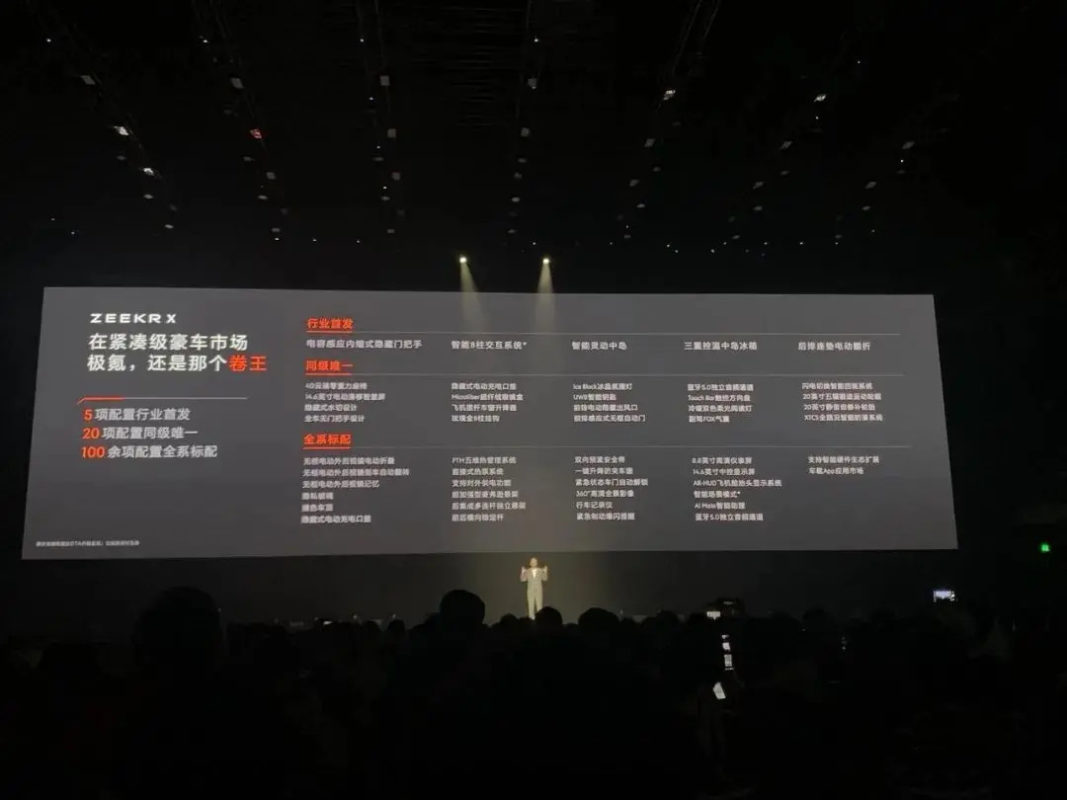

From a product standpoint, to break down the barriers of traditional compact luxury cars being “small in space, meaty in power, and not luxurious,” Zeekr X brought many surprises, such as “the first compact car with a refrigerator in history,” “the fastest compact car in history,” and “the only zero-gravity seat in its class,” and more.

In the words of An Conghui, “In the compact market, our competitors’ spec sheets can’t fit everything they offer, while our spec sheet can’t fit all that we offer. We are the champion of value.”

The Zeekr X is currently the lowest-priced and smallest model in the Zeekr lineup. Although there are competing models in the same segment, such as the BYD Yuan Plus, Aiways U5, Volkswagen ID.3, and smart EQ Fortwo, the Zeekr X’s core competitiveness lies in its approach of using a luxury car mindset to create a “budget-friendly” compact car.

-

Extreme X: A Model That Wants It All

Past experience in the automotive industry has shown that after a price reduction, if a new car’s price is higher than expected by the market, its publicity will quickly disappear. However, as long as the pricing strategy is slightly aggressive, positive reviews and orders will continue to grow.

“The pricing process of Extreme X is mainly based on four factors: scale, the drop in the price of lithium carbonate, market trend prediction, and market competition,” said Lin Jinwen, vice president of Extreme.

So, how impressive is the Extreme X with a starting price of 189,800 yuan?

Taking Smart ForTwo (#1) with a similar price and size range (179,000-279,000 yuan) as an example, consumers can get more seat layouts, stronger performance, longer battery life, and more comfortable configurations for just an extra 10,000 yuan.

If we compare it with Volkswagen ID.3 with a similar size, the highest price difference of 50,000 yuan seems to make it hard for Extreme X to maintain its price advantage.

However, in reality, consumers don’t compare Extreme X directly with Volkswagen ID.3.

The reason is that Extreme X has a clearer product positioning and understands the needs of the users in this segmented market.

For the compact car market in China, users need a small car that is convenient for commuting, while still being refined and exquisite. However, the current best-selling models like BYD Yuan Plus and the value-for-money model Volkswagen ID.3 cannot be considered hexagonal products.

Moreover, the price range of 200,000 yuan is still the mainstream consumption area. Consumers in this price range have the mentality of wanting it all, which is why midsize SUVs costing more than 100,000 yuan could be sold well in the past era of gasoline-powered cars.

Before the launch of Extreme X, the market performance of Smart ForTwo (#1) was a good example.

From Extreme 001 to Extreme 009, and now to Extreme X, Extreme is well aware that there is no brand premium in China’s new energy and intelligent automotive industry. Instead, it is all about whether users approve and are satisfied with the product.

This means that the logic of “making what we sell” in the past has become “giving what users want” today.

At the launch event, Extreme COE An Conghui compared Extreme X with traditional luxury car brands like BBA, repeatedly asking the audience if the price and benefits were enough. This combination of satisfying demand and aggressive pricing replicates the success of Extreme 001 two years ago.

In other words, the popularity of Extreme 001 depended more on the pricing strategy of “striking at a lower dimension,” which was like “buying a BMW 5 Series at the price of a BMW 3 Series.” And now, Extreme X has also broken the inherent product thinking of its competitors with an equally aggressive pricing strategy.

Today’s pure electric vehicle market lacks small cars with high quality based on a pure electric platform.

From the perspective of product strength, the appearance, interior materials/design, and performance of the Zeekr X have set a new benchmark for this level of car, including features such as the Aston Martin-style hidden water-cut design, a 14.6-inch center console screen that can slide left and right, a center armrest that can move forward and backward, and a performance that can accelerate from 0 to 100 km/h in just 3.7 seconds.

On the night that the Zeekr X was launched, the new generation of the Dongfeng Honda HR-V was also launched. Both are compact SUV models, but the latter, as a well-established model that used to sell tens of thousands of units per month, seems to no longer be in the same league.

This can also be seen in the market performance. “Orders in five minutes were several times higher than expected,” said Lin Jinwen, revealing the progress of Zeekr X’s orders.

This seems like a good start, but whether Zeekr X can continue this momentum and become the next explosive product for Zeekr still needs time to be verified.

-

With an annual delivery target of 40,000 units, how much pressure is Zeekr X under?

At the Zeekr X launch conference, An Conghui first mentioned that Zeekr was about to deliver its 100,000th car, which Zeekr achieved in just two years.

From the timeline, Zeekr is highly likely to become the fastest domestic new energy vehicle company to surpass 100,000 units. However, An Conghui’s bigger ambition is to be the fastest domestic company to achieve annual deliveries of over 100,000 units.

Facing a sales target of 140,000 units this year, Zeekr only delivered 15,200 new cars in the first quarter, and at least the current sales trend is not optimistic.

“Zeekr X’s delivery target this year is 40,000 units.” Despite the slowing sales of Zeekr 001 and 009, Zeekr still retains its initial target of delivering 70,000, 30,000, and 40,000 units of Zeekr 001, 009, and Zeekr X respectively.

If we start counting from June, Zeekr X needs to deliver at least 6,666 units per month. In comparison, the smart elf #1, a competitor in the same price range, sold a cumulative total of 12,697 units in the first quarter of this year, with an average of 4,232 units per month, which is a decent performance for a compact pure electric car in this price range, but it cannot yet be called an “explosive product.”

From the market trend perspective, Zeekr X may still have greater market opportunities.

In 2022, the sales of domestic compact new energy vehicles accounted for 35% of the overall market, becoming the largest sub-category, while the total share of A0 and A-class vehicles has risen to 45.2%, indicating that the market is gradually shifting towards a “spindle-shaped” pattern.

According to data from the China Passenger Car Association, in the new energy passenger car market in China in 2022, the cumulative sales of pure electric vehicle models priced above 300,000 yuan were approximately 578,000, while the sales of pure electric vehicle models priced below 300,000 yuan were approximately 3.677 million, making the market size about six times larger for the latter.

For Zeekr, the logic of product planning is to achieve explosive sales in the largest market segment. The Zeekr 001 has become the annual champion for pure electric vehicle models priced above 300,000 yuan, while the Zeekr 009 achieved the sales champion for MPVs priced above 500,000 yuan in its third month of delivery.

For Anconghui, the underlying logic of explosive sales is whether consumers approve of the product, rather than how to make a car that is “easy to sell”. As the lowest-priced and smallest model in the Zeekr brand, the Zeekr X will undoubtedly be an important contributor to Zeekr’s sales targets this year.

In addition to the domestic market, the Zeekr X will also be launched in the European market, but more details will have to wait until the Shanghai Auto Show later this year.